Welcome to Theopetra’s Substack. Subscribe now so you don’t miss our weekly educational posts bridging the gap between cryptocurrency and real estate. Each post will cover a different facet of either the cryptocurrency or real estate space. Whether you are experienced or new to either topic (or both), we think you’ll find value in what we’re working to create.

This inaugural post will set the stage for why we’re creating Theopetra: the rising housing crisis, the failure of government policy around housing, and a new way forward.

Back to the Future

For those of you who remember the 2008 financial crisis, you no doubt see parallels with our current situation. Home prices are skyrocketing, endless media stories about home bidding wars, and an underlying sense of unease that things could come crashing down at any moment.

If you didn’t live through it, here’s a brief summary of what went down.

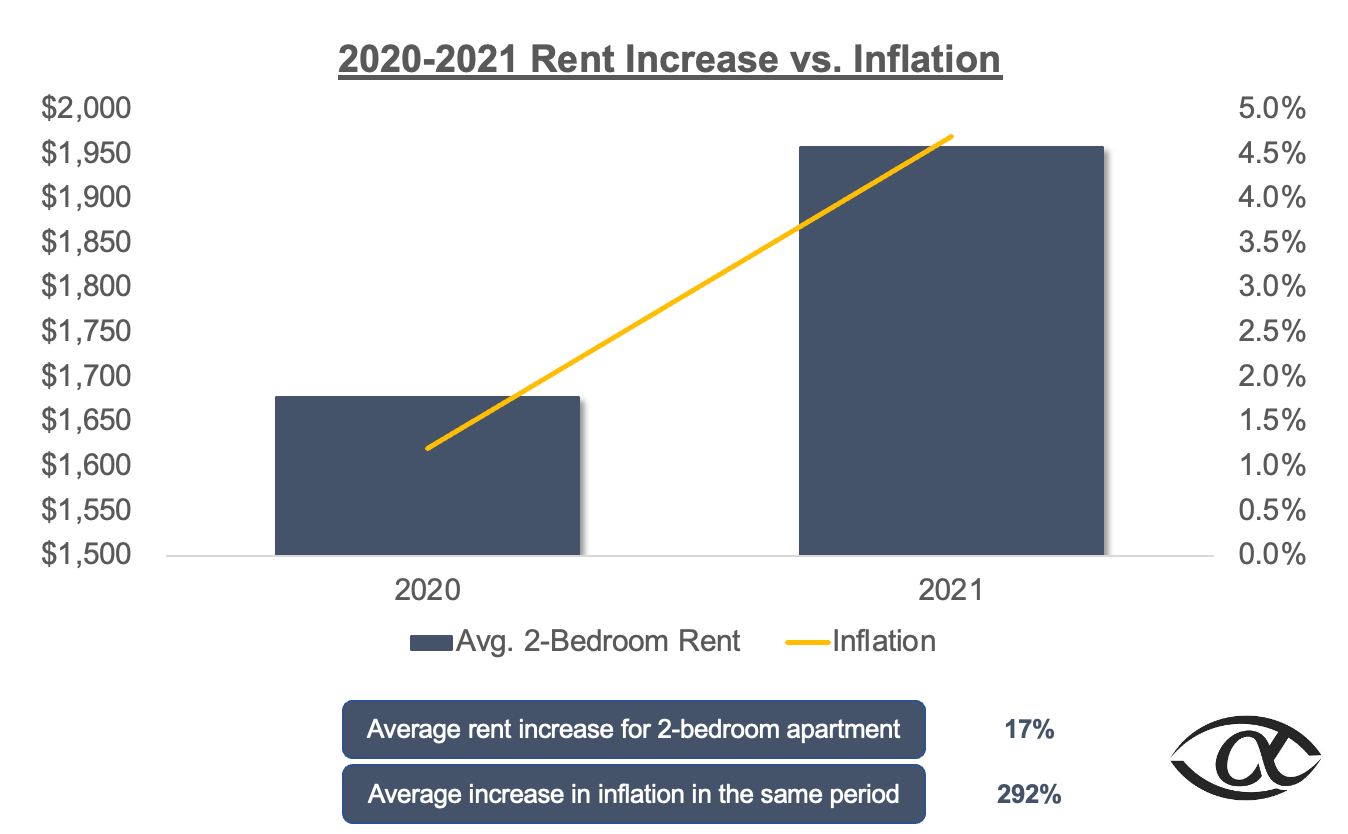

Many of the headlines you see today could have been pulled from 2007-2008, but with one key difference. While the 2008 crash was driven by massive speculation in single-family homes and increasingly alarming debt-to-income ratios among mortgage borrowers, the situation today isn’t restricted to home buyers. Rents nationwide have exploded in the last three years, especially in the hottest markets. Nationally, rents have increased on average 10-15% year-over-year in 2021, in some cases north of 20% (Source: ApartmentGuide.com).

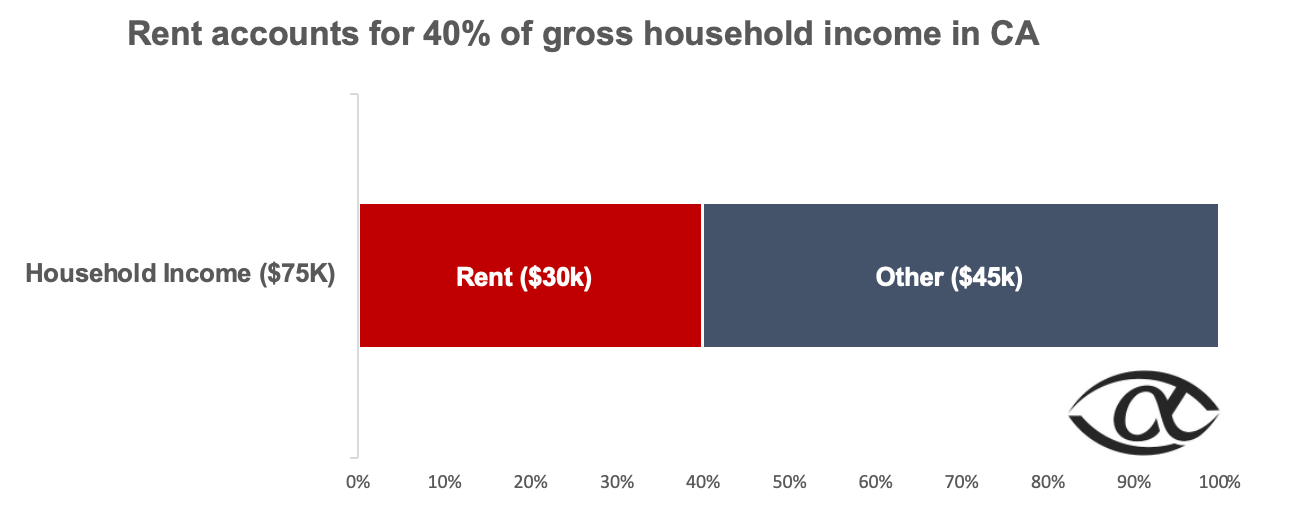

For perspective, at the peak of the 2008 housing crisis, debt-to-income ratios (what percentage of a person/family’s income is needed to make the monthly payment) for newly originated loans climbed above 40%, a level at which default becomes roughly 50% more likely. When housing costs consume more than 40% of gross income (before taxes, car payments, student loans, food, etc.), it becomes incredibly difficult for residents to keep up. Unfortunately, this is exactly what we’re seeing in rental markets across the country.

To add some color to this picture, let’s take a look at conditions in California. Housing trends typically start and are felt first in California and then spread across the country. In the Santa Ana - Irvine market, the median (50th percentile) rent for a two-bedroom home is $2,507 per month. Statewide in California, the median household income came in at $75,235. If we do some simple math, we can see that annual rent ($2,507 x 12 = $30,084) as a percentage of annual income ($75,235) is 39.9%, just under the 40% threshold highlighted above as the tipping point for the 2008 crash (Sources: rentdata.org and census.gov).

If your initial reaction here is “but California is the most expensive,” remember that California also has a much higher average income than the country as a whole. Based on recent trends, this situation of housing costs consuming 40% or more of household income could expand to fit the majority of US markets in the next 5-7 years.

The Government’s Role in This

So what can be done to stop this? First, let’s take a look at the options that governments have at their disposal.

The first option for government influence in rental markets is rent control. Historically we have seen that this measure only helps lessen the intensity of the core issue, but is not a true solution to it. For example, it may come as a surprise to many that the majority of the states in the US already have some form of rent control or preemptions, including some of the most expensive states such as California and New York. In fact, only a handful of states exist that have no form of rent control or preemptions in place, such as Montana, Wyoming, Nebraska, and Maine. This tells us in no uncertain terms that government-mandated rent control does little to alleviate the pain of the people.

Additionally, slowing rent down triggers other events in the economy that can spiral quickly. The typical landlord consists of your mom and pop owner saving up for their kids’ education. Slowing down rent dis-incentives them to own assets, which in turn will slow down GDP growth. In order to offset that, the government may increase taxes to cover up for lower output from the economy. In other words, everyone suffers.

The other alternative for governments is to provide direct assistance to renters in the form of tax credits or stimulus checks. People getting additional cash does not do much to address the core issue, rather it exacerbates an already concerning inflation problem in the country. It is like a bandaid that does more harm than good.

The buying power of people needs to come from a different source in order for the problem to be truly and meaningfully addressed. This is where we think we can help.

A New Way Forward

The Theopetra Model: We have a solution that we believe addresses the buying power of people that is truly unique and does not rely on government handouts or regulations. Reimagining homeownership requires a never-before-seen model.

Theopetra’s model will be two separate entities: the $THEO token on the Ethereum blockchain and the $REAT token on the Stacks blockchain.

The REAT entity (long-form name: Real Equality for America Today) based on Stacks, will purely be focused on expanding its mission. REAT will use cash flow to mine $REAT, which will fuel its flywheel to buy more properties. REAT will implement “self-imposed rent controls” where rent will never increase more than inflation in a given year and will typically fall well below, around 1%.

Theopetra will operate on the Ethereum blockchain with the $THEO token, the utility token for priority access to homes. It will feature bonding and staking for users at its donation event. Theopetra will be the largest miner in the $REAT ecosystem and has a chance of receiving stacking rewards.

This model aims to build a long-term sustainable system to equip the middle class to own homes everywhere. After all, the great crypto experiment will not mean anything if we don’t own the land that we stand on!

We are only getting started. This will continue to dive deeper into how Theopetra will bring it to life over the next few months. We are on the cusp of an innovative and disruptive movement. The future is bright.

TL;DR - “If You Remember Nothing Else”

America is facing a chronic housing problem with no end in sight

Government intervention may be well-intentioned but usually exacerbates the problem

Theopetra will alleviate that problem for many by creating a token flywheel that provides America’s middle class an affordable and stable way to rent and eventually own

How does Theopetra prevent or mitigate a bank-run type situation occurring now in OHM and TIME?