Welcome back to the Theopetra Testament. Subscribe now so you don’t miss our weekly educational posts bridging the gap between cryptocurrency and real estate. This post, composed by our Self-Repaying Home team, will give you a brief update of financial markets in relation to housing before diving into the second part of our series on getting ready to purchase a home.

Market Update:

Current Mortgage Rate: 4.01% 30-year fixed-rate, up significantly from 3.77% last week (Bankrate.com)

Another week, another week of inflation readings hitting new highs, as CPI hits 7.5%. The last time inflation was this high? 1982, with Ronald Reagan in his second year of presidency, Fast Times at Ridgemont High topping the charts, and a small company called Apple in its 6th year of infancy. Unfortunately for us living humans who need food and shelter to survive, the key drivers of inflation are, you guessed it, food and shelter. Yikes!

With inflation the key driver of all markets, economists and traders are now pricing 7 rate hikes over the next 12 months (up from 5 just last time we wrote). Get those savings account deposits ready! /sarc.

Elsewhere, Russia/Ukraine headlines popped their heads up, stocks and most notably tech stabilized, and the employment report showed a massive beat as the economy looks to be firing on all cylinders. Speaking of cylinders, did we mention vehicle inflation is up 40% over the last 12 months?

Going forward we will keep an eye on rumors of an emergency rate hike (no, really) and the see-saw battle of bulls and bears in stocks, as no one below age 60 has ever lived through or invested in an era of such high inflation. Thus, questions and volatility remain historically elevated, with broad-based measures of volatility in markets at 10+ year highs.

Interesting Housing Headlines:

“According to data firm CoreLogic, investors made 27% of all single-family home purchases in the first three quarters of 2021 — up from just 17% at the end of 2019. What’s more: These investors largely focus on the lower- and mid-priced end of the market, meaning first-time homebuyers feel the brunt of their activity” (Money.com).

If only someone was working on a project that would allow homebuyers to make all-cash offers to compete with investors without charging an arm and a leg...

Lesson Two: Home Financing Options

Ok, so you have some money saved up for a down payment or at least a plan to get there. Now is a good time to weigh your mortgage options while you’ve got some time and aren’t trying to simultaneously negotiate the largest purchase of your life and coordinate a cross-country move of everything you own, lol.

Loan Limits

First things first, let’s make sure we are able to borrow enough money to buy the house we want. Borrowing limits are essentially set by the US Government to facilitate and ensure a highly liquid and functional housing market. We don’t want one bank in Kansas slinging $1MM loans while another bank in Georgia is capped at $200K loans. Thus, this ‘cap’ on loans is regulated so it’s a level playing field across the nation, and the GSEs (Fannie, Freddie), functioning out of the DC area, aren’t bound to state by state regulations.

For 2022, conventional loan limits are $647,200 and $970,800 for ‘high cost areas.’ What’s a high-cost area? Glad you asked, here’s a quick link to see if your zip code qualifies (hint, it’s simply traditional HCOL areas): high-cost areas.

Next caveat. The above limits refer to conventional loans. There is also another loan limit for FHA-specific loans; this limit can be as low as $420,680 depending on the area. This brings us to our next distinction:

Conventional vs FHA

The next major consideration is whether you will be rocking a conventional or FHA loan. Generally, conventional loans have better terms but require better credit (~680 FICO+) and more money down (~20%). You can think of a conventional loan as the vanilla type of loan that Fannie and Freddie support and back.

FHA loans on the other hand are directly supported directly by the US Government. It doesn’t take a rocket scientist to realize that if ‘Government’ is directly involved, then the credit box (ie homeownership access) is opening up to a more broad-based cohort of borrowers. With more relaxed credit standards, the terms on the loan itself are generally not as favorable (ie you will pay more in interest if you only put 5% down on a house – this shouldn’t be a huge surprise).

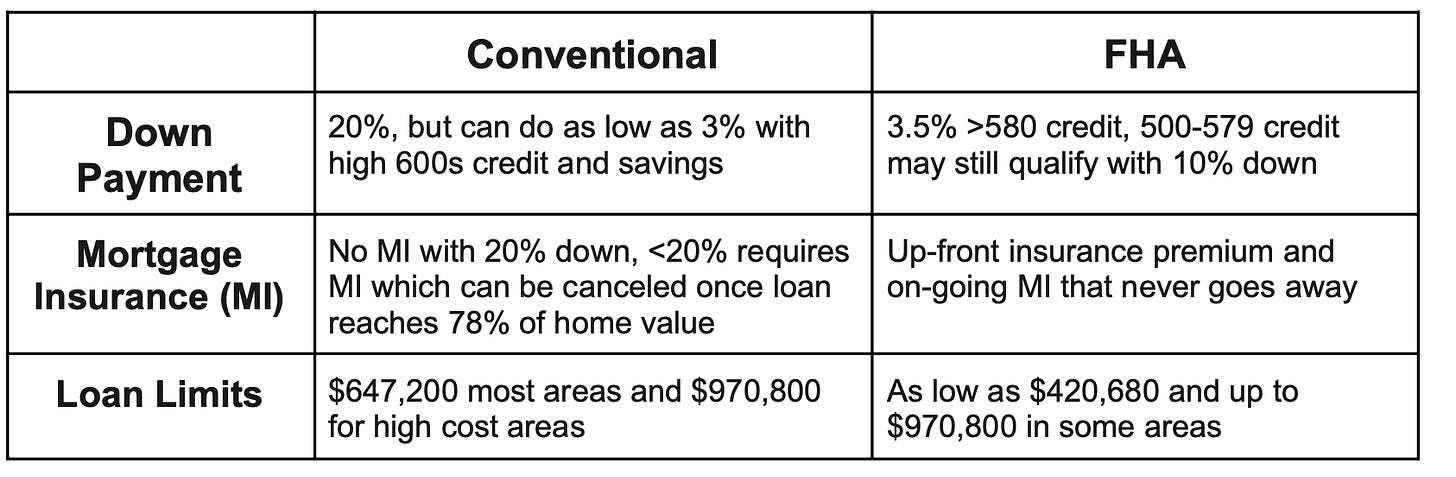

We went ahead and made a quick table to compare the two loan types; no need to get stuck in the detail but it’s important to at least acknowledge and understand the differences:

Interest Rates and the 30-Year Fixed

30-year fixed-rate mortgages are by far the most common mortgage type in the US. Roughly 70% of all mortgages are 30-year fixed! They are so prevalent that we all take them for granted. If you take off your US blinders for a second you will realize that a 30-year fixed rate is rarer than that trait on your NFT you keep telling everyone about, as literally every other country in the world offers mortgages with variable rates or shorter terms. America never really figured out how to nationalize healthcare but we did figure out how to nationalize a mortgage rate.

*RANT ALERT*

The reason the US has a 30-year fixed rate is due to government intervention. It is what it is. No bank in their right mind would offer a borrower a fixed, low rate for 30 years and have to hold that loan until it is paid off. Banks feel comfortable doing this because they sell almost all of their mortgages immediately to Fannie Mae and Freddie Mac (“GSEs” or Government Sponsored Enterprises) who guarantee that the borrower pays, packages the loans together, and sells them as MBS (Mortgage Backed Securities) to investors.

The innovation of the 30-year fixed-rate mortgage combined with MBS no doubt made owning a home more attainable initially but also sent prices skyrocketing. This entire process is called securitization and there are literally books, movies, and college classes on the subject if you want to go down the wormhole. With that said, TLDR- Government intervention in the housing market likely made your parents and grandparents a bunch of money but that doesn’t help you unless you got a fat inheritance. /rant

30-year vs. 15-year

Ok, I know we just dissed the 30-year fixed-rate mortgage but it is the Bitcoin of the mortgage world for a reason. For the vast majority of borrowers, it makes the most sense. Spreading payments over 30 years keeps payments low and manageable while the fixed-rate keeps payments predictable. In an inflationary environment, this is a massive win.

So why do some people take out 15-year mortgages instead? Simply put- lower interest rates and the ability to fully pay off the house sooner. In today’s marketplace a 15-year mortgage has an interest rate ~0.60% lower than a traditional 30-year fixed-rate; with that said, since a borrower pays back the loan over a much shorter time frame, the monthly payment on a 15-year mortgage even with the lower interest rate is substantially higher. On a $400K home, it’s worth about $700, meaning the 15-year mortgage payment is $700 more than a 30-year mortgage payment on the same property (assumes 20% down).

15-year mortgages are typically not common for first-time homebuyers. Most of us are lucky to even buy a home let alone consider an option that has us paying $700+ (or more) each month. If you do want a 15-year, think about the flexibility of paying more monthly on a 30-year instead. Once you sign up for a 15 year you can’t change back without refinancing and if you experience a financial hardship you may have a difficult time refinancing to a 30 year.

For the degens and math geeks out there, if you think your investment returns (or inflation) will be higher than your mortgage rate you should take the longer loan term and go with a 30-year.

Adjustable Rate Mortgages (ARM)

Adjustable Rate Mortgages are sometimes used as an affordability product due to the lower initial rate, but much like a plastic bottle of tequila, there may be repercussions later on. In a nutshell, the borrower gets a ‘teaser’ rate that is fixed over a short time frame and then floats to a ‘true’ market rate.

ARM payments are spread over 30 years but, as mentioned above, the interest rate is only fixed for a set number of years (3, 5, 7, or 10) before adjusting every 6 months based on market rates at the time. People take out this type of loan for the lower initial rate (currently ~2.50%-3.50%) but you need to be careful that if rates move higher in the future you can still afford your payment. There are two great use cases for ARMs:

You know for a fact you are going to move within a set period of time. Example- You are relocating for a 5-year work assignment before moving again. Feel free to take out a 5, 7, or 10 year ARM with a lower rate than a 30-year fixed, and by the time the rate starts fluctuating, you will be gone. Why overpay for the 30-year rate when you know you will be bouncing in ~5 years?

You expect rates to go down in the future AND can afford to be wrong. Rates have been moving lower for the better part of the last 30 years, so if you had an ARM your rate would have adjusted lower making it a great deal. Now may not be a great time to bet on lower rates with the Fed supposedly about to raise rates and inflation soaring. Stick to betting on March Madness.

“Other” Mortgage Types

OK, this is the dreaded “other” category. There are many more niche mortgage types with varying qualifications. One of the most common is the Veterans Affairs (VA) mortgage program - if you qualify for this, we at Theopetra would like to thank you for your service! VA loans typically offer 0% down payment and better terms than traditional mortgages so definitely consider this option if you qualify.

Some mortgage programs may offer better terms if you are a first-time homebuyer or have an income below a certain level relative to your area. To take advantage of these programs you typically don’t need to do anything different on your end as your mortgage lender will factor those in, but it’s good to know.

Last thing. The above two paragraphs don’t do justice to the numerous options in mortgage products as there are literally entire industries and businesses that have developed over time to create, underwrite, and promote new mortgage products. But we at least wanted to give them a shout-out and give you an introduction to the melting pot of other mortgage products.

Wrap it Up and Next Steps

In this second installment, we’ve briefly gone through many of the different mortgage decisions you’ll need to make as you consider buying a home. Next, we’ll take a closer look at the factors that impact your mortgage rate and fees.