Today, we are going to introduce you to our (imaginary) friend Bob and follow him through his journey to becoming a homeowner. We will show you in black and white the cost-savings and significant benefits that Theopetra Labs brings to homeowners, and will also detail how the experience with Theopetra Labs (and T-Homes) contrasts with the current TradFi route.

After all, if we are to fulfill our mission of transforming 10,000,000 (that’s right) Americans into homeowners, we must alleviate existing obstacles while making T-Homes better than anything available to home buyers today.

You may recall that we dove deeper into the true definition of “homeownership” and “money” (read it here) to bring clarity to this thorny problem. Now we will follow the story of Bob and will compare three homebuying options. Let’s see how this plays out.

Meet Bob – Potential Homeowner

Bob is a sales professional living in Southern California whose annual salary is $100,000. He has worked a professional job for a few years now and is ready to achieve the next milestone in his American dream: homeownership. Let’s consider Bob’s financial health for a minute. Bob’s net income is roughly $5,550/month (assuming a 24% federal tax rate and 9.3% for CA). He is currently renting an apartment for $2,400/month and has recurring monthly bills of $1,500. This leaves Bob with $600/month to put in his piggy bank to save for a condo.

Bob starts to explore his options and decides that he has three choices:

Rent (now) and save for a starter home, then buy a condo (later, but how much later?)

Rent (now) and save for a land lease condo (later, but how much later?)

Rent (now) and save, then buy a T-Home (later, but how much later?)

Bob has to travel slightly different paths for each of the scenarios above with varying levels of ease, access and returns. Let's break these down.

We will assume an interest rate of 5% for all scenarios.

Scenario #1: Rent Now Followed by TradFi Condo Purchase

As noted above, Bob is currently paying $2,400/month in rent. Area rents are increasing by an average of 5% per year.

Bob researches potential condos in the area and sees that the lowest-priced 2-bedroom condo currently on the market is listed for $615,000. The average and median price for a similar condo in this particular zip code is over ~$900,000. Yikes!

With a monthly savings of $600/month, the American Dream of homeownership is starting to feel a bit out of reach for Bob.

Even if Bob chooses to go for the cheapest option in the market (see below), the picture doesn’t get better.

Wow, they have a community pool! Must be a great place to end up if it means being a home (condo) owner, right? Well, let’s see what that means for his monthly finances.

If Bob buys the condo at today's asking price of $615,000, a down payment of 5% equals $30,750. His loan amount will be $584,250. With a 30-year fixed rate mortgage, Bob’s monthly payments (PITIA) would be ~$4,150.

But wait. Bob’s monthly net income is $5,550, less $1,500 for recurring expenses, leaving him with $4,050 for a mortgage. No lender in their right mind (and who follows US Federal Regulations) would lend Bob the full loan amount because his income cannot support it.

In order to sustain a mortgage of this amount (and comply with underwriting regulations), Bob’s income would need to increase by almost 59%. *GULP*

When was the last time anyone got a 59% raise? Even switching jobs typically leads to an optimistic salary increase of 20%. But hey, let’s pretend that Bob strikes gold in the job market and manages to get that 59% increase in pay by Year 3 – that's $58,400 in additional annual gross income.

Assuming that Bob continues saving $600/month for a condo purchase, his savings per year would be $7,200.

For simplicity’s sake, let’s assume that real estate prices increase just 5% per year. This means that the same condo that was priced at $615,000 today would be valued at and cost Bob approximately $824,159 six years from now! The purchase price and associated down payment goal posts have moved. Instead of saving 5% of $615,000 ($30,750), he must now save 5% of $824,159 ($41,208). That’s over 34% more than if he were to buy the condo today!

But wait, there’s more. Bob’s monthly payment on that loan six years from now would be $5,217/month instead of $4,150/month. Yikes!

The more time it takes Bob to accumulate the necessary down payment, the farther the goal post moves. Bob, along with millions of Americans, are stuck in a perpetual treadmill and are in an eternal state of trying to catch up. No matter how fast he runs, his progress is minimized by the fading checkered flag in the distance.

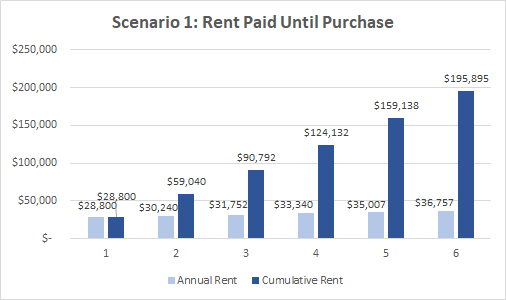

Not only has Bob’s target moved while he has been busy saving, but he has also been paying rent. Recall that Bob’s monthly rent payment increases by 5% per year. If it takes Bob six years to purchase a starter condo, here is what his cumulative rent payments will look like:

To summarize, after spending a cumulative $195,895 in rent over six years, while saving over $41,000 for a down payment, Bob might finally be in a financial position to purchase that 2-bedroom condo.

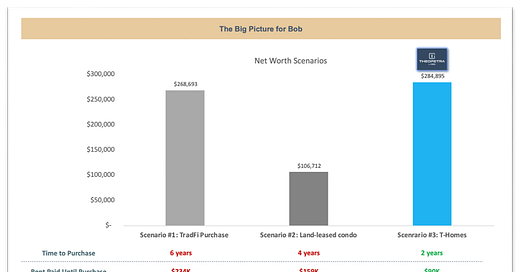

Consider that four years after Bob makes the purchase (10 years from today), his condo would be worth approximately $1,001,770 (5% annual appreciation). His mortgage principal balance would sit at $733,077, leaving him with total home equity of $268,693.

Scenario #2: TradFi Land Lease Condo Purchase

Saving up for a starter condo isn’t looking very appealing to Bob. What about a standard land-leased condo in the local area? Let’s look into it.

A land lease involves a combination of buying a home and renting the land it sits on. This kind of agreement can be a less expensive route to homeownership, but also comes with drawbacks that warrant careful consideration, such as the potential for lease increases, there is less flexibility when you decide to move, and it can be tricky to obtain a mortgage for a property on leased land.

This option also does not provide the owner with any rights. Bob would still be renting the land. We’ve heard it put this way: “Buying a property on leased land is like buying a home on a cliff that is slipping. The view is great, and it comes cheap. But eventually, it will slide downhill leaving the owner with nothing.”

Let’s go back to Bob’s situation. The following land lease option is available his desired area with the lease expiring in 2056. There is a land lease fee of $9,200/year.

Using the same assumptions for savings and appreciation that we used previously, Bob would need to have $22,495 to fulfill the 5% down payment requirement at today’s purchase price. At his standard savings rate of $600/month, it would take Bob just over three years to save this amount. However, after three years, the value of the property will have increased to $520,815, requiring a down payment of $26,041. (Cue the goal post moving further away.) Thus, Bob will actually need to continue saving for a total of four years before he can afford to make the purchase, and the property will then be worth $546,856.

While Bob is saving, he of course is continuing to pay rent. His total rent payments over four years would total $124,132.

How does that impact his total equity over the long term? Six years after his land lease and property purchase (10 years from today), Bob’s condo would be worth $732,840 and the principal balance on his mortgage would be $626,928, leaving him with equity of $106,712.

Not only does the land lease option leave Bob with a lower net worth than purchasing a condo outright via Scenario #1, it also leaves him with no rights to the land once the lease is over.

Both scenarios shown above highlight the precarious nature of a homeowner’s journey for America’s middle class. It’s a constant fight to stay afloat financially, battling ever-changing goal posts and overcoming insurmountable challenges. The existing deck is stacked against the vast majority of Americans today.

What other choices does Bob have to purchase a home? Can T-Homes and Theopetra Labs make a dent in the universe and help Bob out? Let’s take a look.

Scenario #3: T-Home Purchase

In case you need a refresher of T-Homes and how we will be adding inventory to the housing market, read this. (Go ahead; read it). Now that you’re back, you know that T-Homes is a private company specializing in home loan products that allow for only 2% down payment instead of 5%. A T-Home loan also does not require Private Mortgage Insurance (PMI) like a typical home loan with less than 20% down payment does, and this can save the buyer hundreds of dollars a month.

Consider this apartment complex that is (hypothetically) owned by T-Homes; it has 32 one-bedroom units and 16 two-bedroom units.

T-Homes is offering the one-bedroom units for $479,000 and the two-bedroom units for $550,000.

We know that Bob prefers a two-bedroom unit, so he is starting to save for the down payment. He knows that this is a T-Home, so he only needs to save 2% of the purchase price or $11,000! This feels much more attainable to him.

Bob also discovers that with a T-Home purchase, he does not need to pay any closing costs such as title, processing fees, appraisal costs, recording fees, or any prepaid escrow account set up for taxes or insurance! The $11,000 and a one-time underwriting fee are literally ALL that is required financially from Bob before he can complete the purchase!

Bob can now become a homeowner years sooner and for significantly less money up front than TradFi has allowed. Furthermore, the T-Home condo comes with a garage and is in better condition than the standard market condos we looked at above.

Ok But What’s the Catch?

Well, it’s less of a catch and more of a creative method of financing. Bob would pay a slightly higher interest rate (0.5%) compared to a TradFi option, and he would also split part of the property appreciation with the bank Also, Bob would not be able to utilize property taxes as a deduction on his tax returns. However, we are confident that most people in Bob’s situation place a higher value on homeownership at a lower cost versus receiving a potential tax benefit once a year.

Under a T-Homes scenario, the bank can potentially reap greater returns down the line, but more importantly, the bank will receive returns when Bob receives returns himself in the form of appreciation. With his T-Home, Bob does not have to worry about a lease coming to an end or his monthly payment getting increased. Bob keeps 75% of the appreciated value and gives 25% to the bank. Did we just create the benevolent bank with a win-win situation? Maybe we should also try our hand at creating a unicorn, or better yet, a politician who does not lie!

Back to Bob’s story. If he wants to purchase a T-Home, he will need to continue renting and saving for only two years!

Based on our assumptions, the value of the condo after two years would be $606,375 and his down payment would only be $12,128! Hooray! Bob is the proud owner of a two-bedroom condo that comes with a garage, in Southern California! And he only had to save for TWO YEARS!

But that is only part of the story. Let’s play out the full scenario to see how this arrangement impacts Bob’s home equity (and a large part of his net worth) after 10 years from today (and 8 years of homeownership). We again are assuming 5% appreciation, so Bob’s T-Home loan balance would be approximately $516,032 and the value of the home would be approximately $895,892. This would put the home equity at $379,860.

In T-Homes, Bob shares 25% of the home’s appreciation with the bank. Since the total equity is $379,860, Bob’s portion of 75% equity would equal $284,895 and the bank’s portion would be $94,965.

Comparing Bob’s Options

Let’s review all three options and see which one looks the most appealing for Bob:

The winner for Bob is crystal clear. Even after splitting appreciation on his T-Home and having a slightly higher interest rate than a TradFi loan, Bob is still better off in every category! He is able to purchase a T-Home in only two years and thus, he will end up paying the least amount of rent prior to buying. He also needs to save significantly less money for the down payment, AND his monthly mortgage payment will be the least expensive of the three options!

Theopetra Labs and T-Homes are passionate about bringing significant change to Bob’s life and millions of Americans’ lives that have had the deck stacked against them in the world of traditional finance. Be sure to follow us on Twitter @TheopetraLabs and sign up for the T-Homes whitelist at www.thomecapital.com.